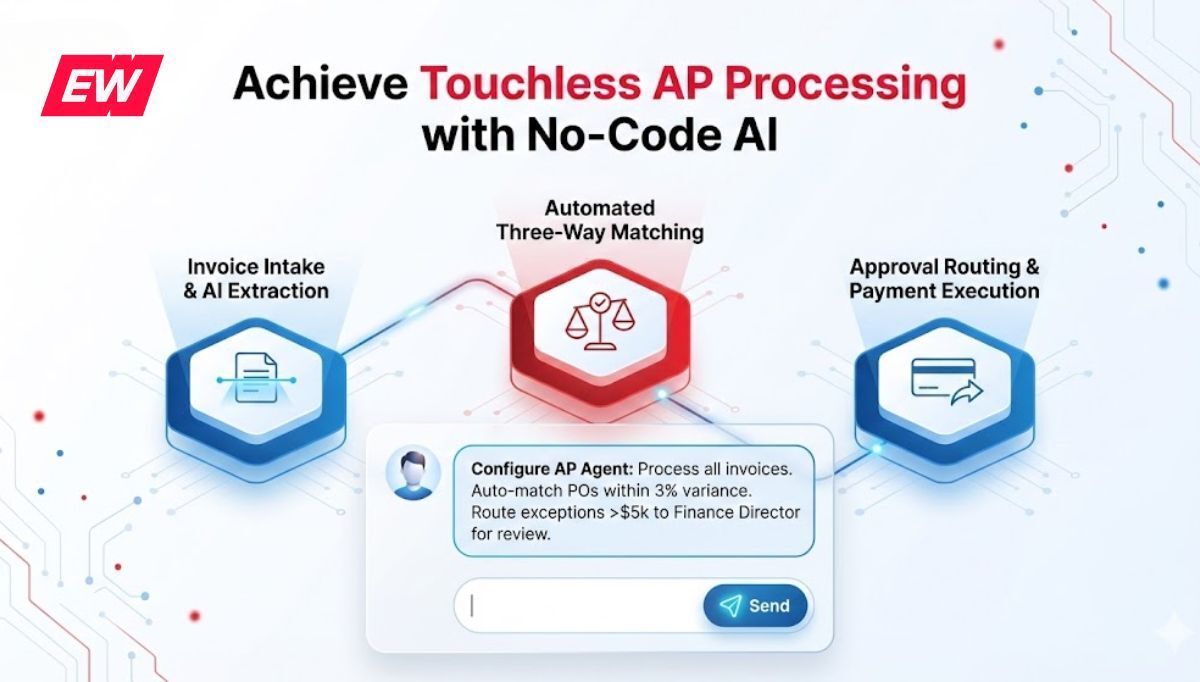

Accounts payable automation using no-code AI agents replaces manual invoice intake, three-way matching, exception handling, and payments with autonomous workflows you configure in plain language. These agentic systems read any invoice, follow your approval rules, integrate with ERP, and drive touchless processing, lower cost per invoice, and faster cycle times without coding.

AP leaders don’t need another tool—they need invoices to move from inbox to paid without delays, errors, or headcount spikes. No-code AI agents finally make that possible. They learn your policies, connect to your ERP, handle exceptions, and optimize payment timing—without an IT backlog. According to Ardent Partners’ State of ePayables 2024, Best-in-Class AP teams process invoices 82% faster and at 78% lower cost than the average—gains now reachable with agentic automation.

This guide shows business leaders exactly how to implement accounts payable automation using no-code AI agents: what they are, where they deliver ROI fastest, how to integrate with existing systems, and how to launch in weeks—not months. You’ll also see how EverWorker’s AI workforce approach turns AP from a cost center into a cash and control engine.

Why No-Code AI Agents Change AP Now

No-code AI agents bring autonomous decisioning to AP: they read invoices, match POs and receipts, route approvals, and execute payments within guardrails. Because they’re configured in natural language, finance can deploy automation without engineering sprints—and scale to new vendors, formats, and policies quickly.

Traditional AP automation depended on rigid rules, templates, and ongoing IT work. Every new vendor format, exception type, or policy change created a maintenance backlog. Agentic AI removes that fragility. Models interpret unfamiliar layouts, learn from past decisions, and propose the next best action—reducing human touch while strengthening controls. Oracle NetSuite’s 2025 trends note that two‑thirds of finance pros expect AP to be fully automated—no-code AI agents are how you get there.

What are no-code AI agents for AP?

No-code AI agents are configurable digital workers that execute end-to-end AP tasks—invoice capture, validation, three‑way matching, approvals, and payments—without scripting. You describe policies and workflows; the agent carries them out, learning from corrections to improve accuracy and straight‑through processing over time.

How do they reduce invoice cycle time?

Agents process invoices on arrival, validate fields, and attempt matches instantly. Exceptions are resolved with context or routed to the right approver with suggested fixes, shrinking wait states. Research summarized by Payables Place shows Best‑in‑Class AP achieves 82% faster cycles—agentic automation makes that performance repeatable.

Where does finance stay in control?

You define approval thresholds, segregation of duties, vendor risk tiers, and payment timing. Agents operate within those controls, preserving audit trails and providing explanations for actions. This strengthens compliance while removing manual swivel‑chair work.

What Matters to Business Leaders Evaluating AP Automation

For a composite line-of-business leader, the priorities are clear: provable ROI, minimal disruption, strong governance, and fast time‑to‑value. No-code AI agents meet those requirements by compressing implementation timelines, integrating with existing ERPs, and delivering measurable cost and cash‑flow gains.

Start with the economics. Ardent Partners data indicates the average cost to process an invoice is roughly $12–$13, with leaders under $3. Agentic AP lowers labor and exception costs while recapturing early‑pay discounts. SAP Concur’s 2025 report also finds AP teams are spending fewer hours per week on invoices as automation rises.

How quickly can we deploy without IT backlog?

No-code configuration and prebuilt connectors limit engineering lift. Many teams pilot focused use cases in 2–4 weeks, then scale. With EverWorker, finance configures policies in natural language and connects ERPs via our Universal Connector to move from pilot to production rapidly.

Will it work with NetSuite, QuickBooks, or SAP?

Modern agents connect through APIs to leading ERPs and accounting systems. EverWorker’s Universal Connector imports OpenAPI specs to auto‑generate actions, accelerating secure integrations with NetSuite, QuickBooks, Microsoft Dynamics, SAP, and banking portals.

How are auditability and controls handled?

Every action is logged with who/what/when/why artifacts. Agents enforce approval matrices, SoD, and tolerance levels, and they retain evidence (invoice, PO, receipt, policy) to support internal and external audits.

The Transformation You Can Achieve with Agentic AP

Adopting no-code AI agents produces three compounding outcomes: speed (touchless processing), savings (lower cost per invoice and captured discounts), and stronger risk management (fewer duplications and fraud attempts). The result is an always‑on AP function aligned to cash and compliance goals.

AI agents excel at extracting data from any invoice format, resolving minor mismatches automatically, and recommending actions for exceptions. They also optimize payment timing, balancing DPO targets with early‑payment economics. GEP analysis of Ardent’s 2024 metrics cites an average 9.2‑day cycle; agentic AP compresses that to minutes for most invoices.

Time and efficiency gains

Expect the majority of non‑PO and PO‑based invoices to move hands‑free after a brief learning period. Agents triage and resolve common issues, cutting back‑and‑forth emails, queues, and after‑hours surges. Teams redeploy to vendor management and cash optimization.

Financial impact and ROI

Reduced cost per invoice, fewer late fees, and higher discount capture improve unit economics. Several benchmarks show automated AP costs can be 50–80% lower than manual processes; Ardent’s Best‑in‑Class profile sets the target for sustainable savings.

Quality, compliance, and vendor experience

Duplicate invoice detection, bank‑detail verification, and policy enforcement reduce leakage and fraud. Vendors benefit from faster approvals and predictable payments, strengthening relationships and unlocking better terms.

How to Implement No-Code AP Automation in 60 Days

Successful deployment follows a phased approach: prove value quickly, then scale methodically. Below is a pragmatic, finance‑led plan that minimizes disruption while maximizing learning and stakeholder buy‑in.

- Week 1: Baseline and scope. Quantify current cycle time, exception rate, and cost per invoice. Prioritize one high‑volume vendor cohort and 1–2 invoice types.

- Weeks 2–3: Connect systems. Use prebuilt connectors to your ERP and banking portals. Map approval matrices, tolerance levels, and SoD rules in natural language.

- Weeks 3–4: Train on your data. Upload historical invoices, POs, and receipts. Validate extraction accuracy and matching performance in “shadow mode.”

- Weeks 5–6: Go live for Tier‑1 invoices. Enable autonomous processing for the scoped cohort. Keep exceptions routed with agent‑suggested resolutions.

- Weeks 7–8: Expand and optimize. Add vendors, invoice types, and payment optimization. Tune policies to increase straight‑through processing and discount capture.

For detailed finance use cases and cross‑function ideas, see our primer on AI accounting automation and this roundup of 25 examples of AI in finance.

Can agents handle three‑way match without templates?

Yes. Modern systems match invoice, PO, and receipt by understanding line‑item context, partial receipts, and price/quantity variances within tolerances. Templates aren’t required; the model learns from your past resolutions.

What about legacy ERPs and supplier portals?

Where APIs are limited, Universal Connector methods and secure automations bridge gaps while maintaining auditability. For supplier portals, agents can log in with scoped credentials to retrieve documents and post payments under strict guardrails.

Will AI replace our AP team?

No—AI removes repetitive work so your team focuses on vendor relationships, cash strategy, and analytics. Roles shift from data entry to exception oversight and value creation.

Why the Old AP Playbook No Longer Scales

Rule‑based tools and OCR templates break under vendor variability, new formats, and policy changes. No‑code AI agents continuously learn and coordinate end‑to‑end processes, turning AP from task automation to outcome automation—cash‑flow aligned, audit‑ready, and business‑user led.

Legacy approaches require IT projects for every change and still push edge cases to humans. Agentic AP handles ambiguity, preserves governance, and improves with every invoice. As Forrester’s 2025 guidance highlights, AI value concentrates where processes are repeatable, data‑rich, and decision‑driven—exactly AP.

If you’re planning broader AI adoption, our 90‑day roadmap covers organizational readiness and sequencing: AI strategy planning: where to begin in 90 days. For cross‑functional ideas, explore AI solutions for every business function.

Action Steps to Launch Agentic AP

Turn insights into impact with a simple, leader‑friendly sequence that moves from assessment to deployment while aligning finance, procurement, and IT.

- Immediate (This week): Measure your baseline—cycle time, exception rate, cost per invoice, late fees, and discount capture. Identify top vendors and invoice types by volume.

- Short term (2–4 weeks): Pilot a no‑code AI agent on one vendor cohort. Connect your ERP, define approval rules, run in shadow mode, then enable autonomy for Tier‑1 cases.

- Medium term (30–60 days): Expand coverage to more vendors and add payment optimization. Track gains against baseline; tune tolerances to boost straight‑through processing.

- Strategic (60–90 days): Extend to supplier onboarding, vendor risk checks, and PO creation. Integrate analytics to forecast cash and optimize DPO with discount economics.

- Transformational: Establish an AI workforce for finance—an orchestrated set of agents spanning AP, AR, close, and forecasting that continuously learns and improves.

How EverWorker Delivers These Results

EverWorker provides AI workers—not point tools—that execute your complete AP workflow end‑to‑end. Using EverWorker Creator, finance leaders describe the process in natural language; our always‑on AI engineering team builds the worker, connects your ERP and banking systems via Universal Connector, and validates extraction, matching, approvals, and payments—no code required.

What this means for AP: autonomous invoice capture across formats; three‑way match with learned tolerances; exception triage with suggested fixes; approval routing that respects SoD; duplicate and fraud detection; and payment scheduling that balances DPO with early‑pay discounts. Every action is logged for auditability.

Teams typically move from pilot to production in weeks, not months, and see major efficiency gains: faster cycle times, reduced cost per invoice, and higher discount capture. Because AI workers learn from corrections, performance compounds over time without constant reconfiguration.

The question isn’t whether AI can transform AP—it’s where to start for the fastest ROI in your environment. Get tailored guidance below.

The question isn't whether AI can transform your accounts payable, but which use cases deliver ROI fastest and how to deploy them without the typical implementation delays. That's where strategic guidance makes the difference between pilots that stall and AI workers that ship value in weeks.

In a 45-minute AI strategy call with our Head of AI, we'll analyze your specific business processes and uncover your top 5 highest ROI AI use cases. We'll identify which blueprint AI workers you can rapidly customize and deploy to see results in days, not months—eliminating the typical 6-12 month implementation cycles that kill momentum.

You'll leave the call with a prioritized roadmap of where AI delivers immediate impact for your organization, which processes to automate first, and exactly how EverWorker's AI workforce approach accelerates time-to-value. No generic demos—just strategic insights tailored to your operations.

Schedule Your AI Strategy Call

Uncover your highest-value AI opportunities in 45 minutes.

Build AP That Runs Itself

No-code AI agents let finance teams achieve what once required large IT projects: touchless invoice processing, resilient controls, and cash‑positive payment timing. By starting focused and scaling fast, you’ll compress cycle times, lower costs, and strengthen auditability—without adding complexity. Ready to see your AP operate like an always‑on workforce? Let’s design your first agent and ship it in weeks.

.png?width=300&name=LinkedIn%20Native%20Articles%20(6).png)